By BECKY KISER

Hays Post

The Hays City Commission will consider two rezoning requests on East 27th Street at its work session this afternoon.

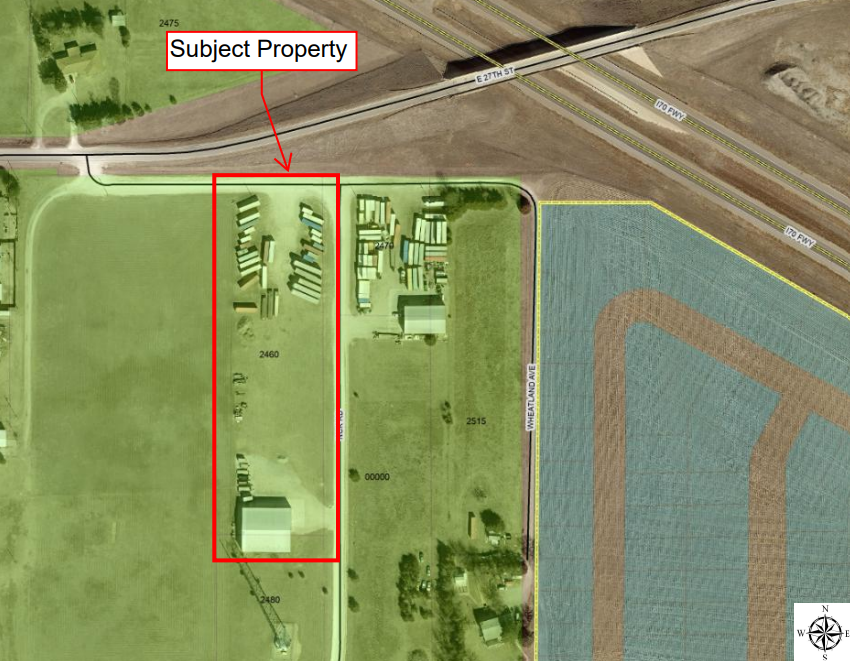

The first request is to rezone property at 2460 E. 27th St. from an agricultural district to a light industrial district.

The property is owned by L&A Enterprises. The owner wants the zoning change in order to expand services.

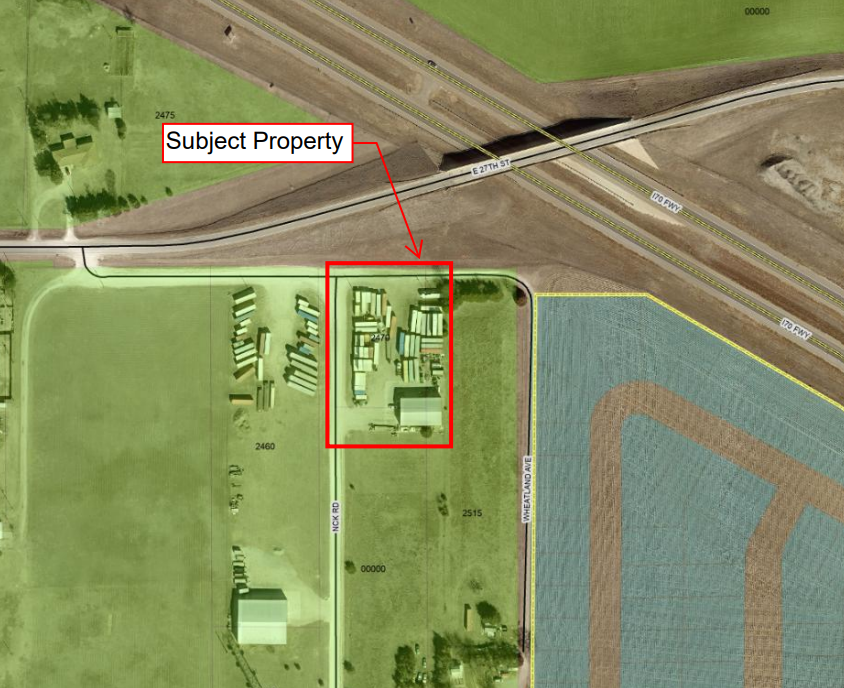

The second rezoning request is for the adjacent property at 2470 E. 27th St., owned by Josh Ziegler, to change the designation from general commercial district to light industrial district.

Ziegler owns and operates T.S.B. Storage on the property.

The Hays Area Planning Commission is supportive of both requests.

24-7 Travel Plaza

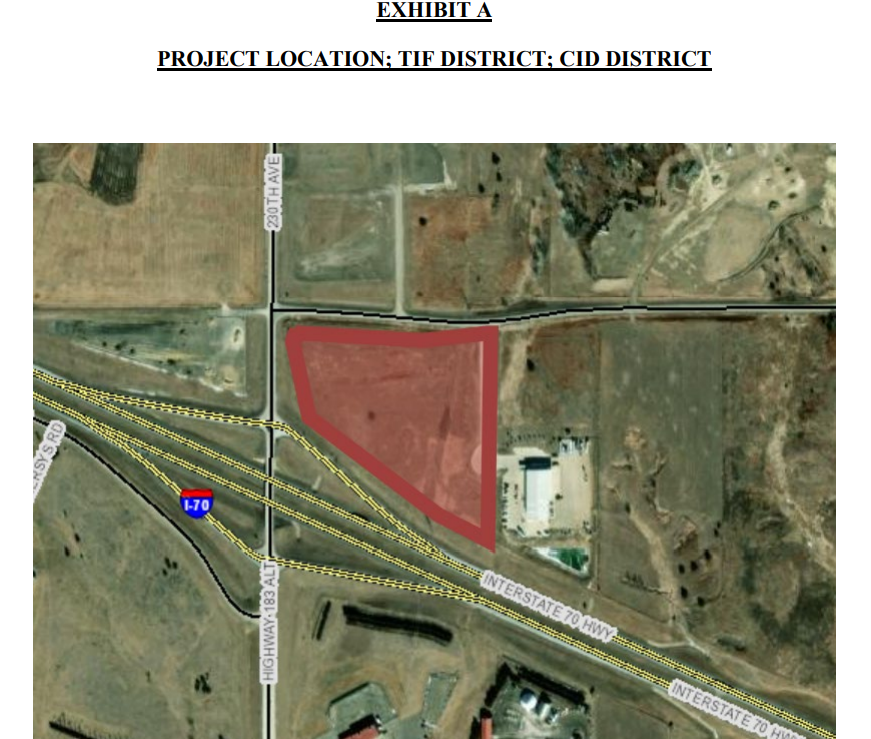

The other two agenda items involve the planned 24-7 Travel Plaza at Interstate 70, Exit 157.

Two resolutions are calls for public hearings, one for a Tax Increment Financing (TIF) project plan and the other for a Community Improvement District (CID).

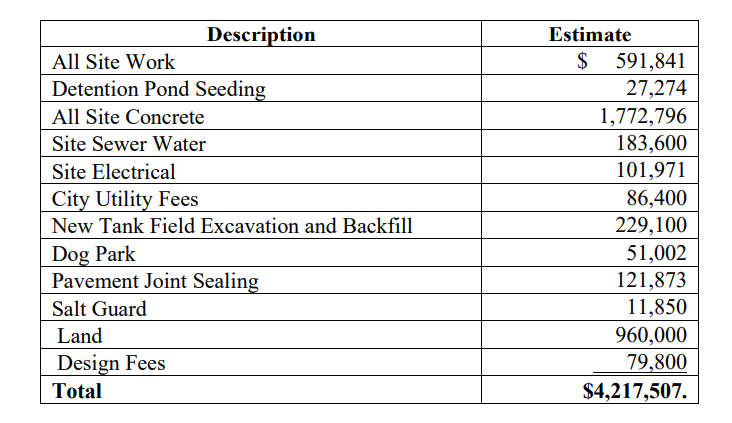

The financing district would capture all incremental property tax revenues within the TIF District, but no sales taxes, in line with the city’s economic development policy. No bonds would be issued.

The developer estimates that the TIF would generate $4.5 million during its 20-year life for TIF-eligible expenses.

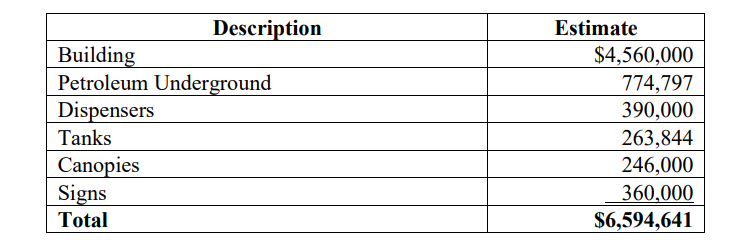

Within the improvement district, a 2% CID sales tax would be imposed in addition to the city's current 2.25% sales tax.

The CID sales tax revenues would be used to reimburse the developer on a pay-as-you-go basis for CID-eligible expenses, primarily related to the private construction costs of the Travel Store, gas pumps and related private improvements.

The developer estimates the CID sales tax would generate about $2 million to fund CID-eligible expenses during its 22-year life.

The complete Feb. 19 agenda is available here.

The work session starts at 4 p.m. in Hays City Hall, 1507 Main.