By BECKY KISER

Hays Post

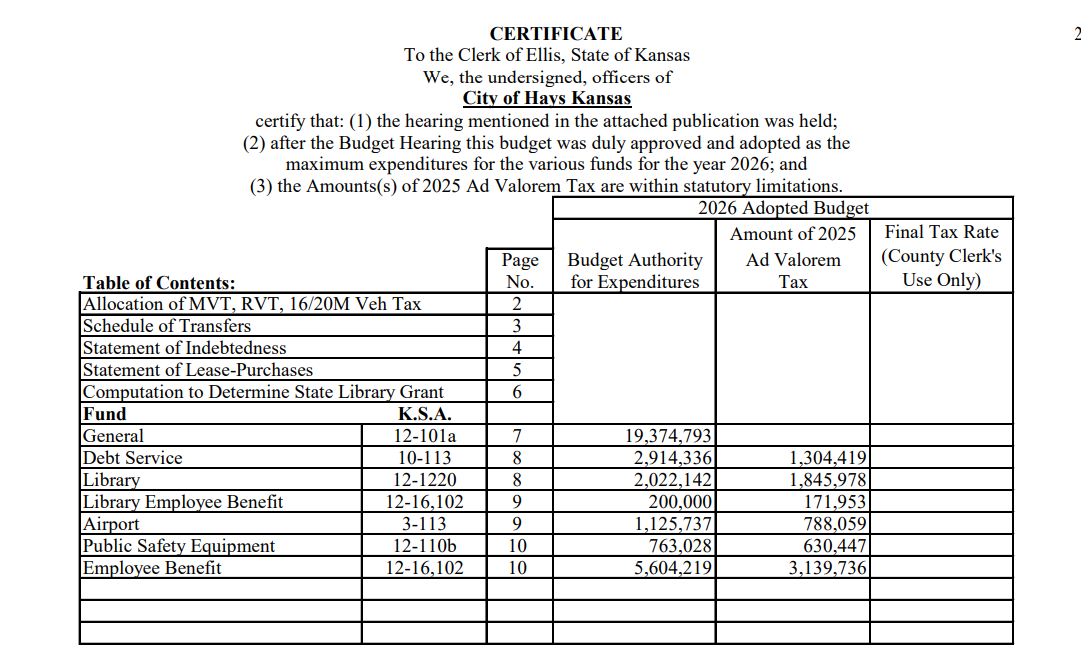

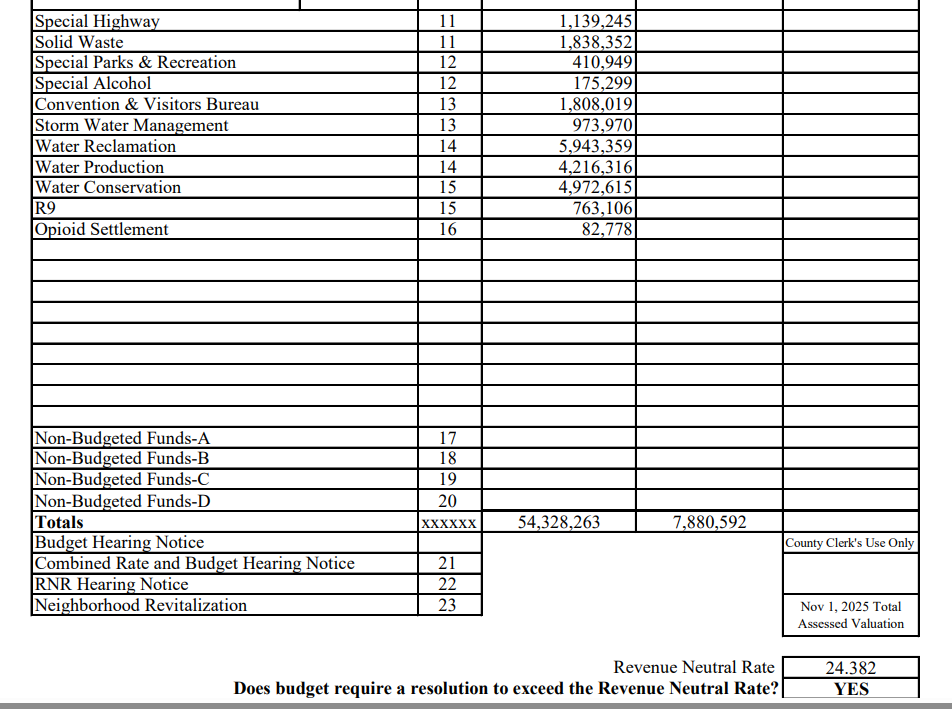

Hays city commissioners will conduct two public hearings on Thursday regarding the 2026 budget of $54.3 million.

The 2026 mill levy remains at 25 mills for the 17th consecutive year, while assessed valuation increased by 2.5%.

"Because the city's valuation is up, the amount generated by the 25 mill levy will also increase," said Collin Bielser, deputy city manager.

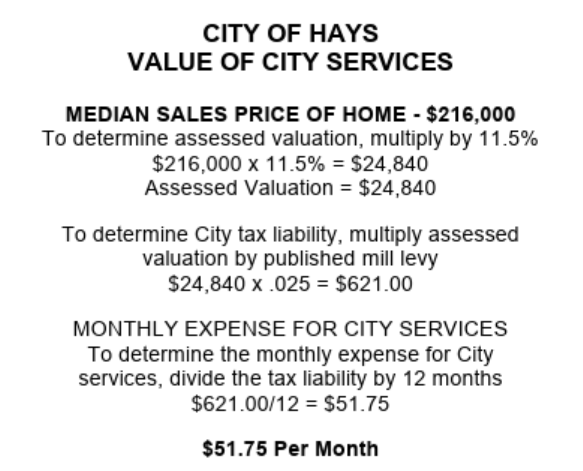

According to example statistics supplied by city staff, the median sales price of a home in Hays is $216,000. The state's residential rate of assessed valuation is 11.5%, equaling $24,840. The assessed valuation is then multiplied by the city mill levy of 0.25, equaling $621 as the amount owed in 2026 city property tax.

A hearing will be held first to exceed the revenue-neutral rate of 24.382 mills in the city's property tax levy.

Commissioners will then take a roll call vote on the resolution.

The public hearing and vote on next year's budget will follow.

The 2026 Budget can be viewed in its entirety by visiting https://www.haysusa.com/392/Budgets

The meeting will start with three nuisance abatements recommended by Jesse Rohr, public works director for

• 515 E. 11th

• 1716 Douglas Drive

• 231 E. 12th

The complete Sept. 11 agenda is available here. The meeting starts at 4 p.m. in Hays City Hall, 1507 Main.