By TONY GUERRERO

Hays Post

Ellis County Appraiser Eugene Rupp said implementing a property valuation cap, such as a 3% limit, could lead to disparities in local housing markets.

Rupp discussed proposed state legislation with the Ellis County Commission during its Wednesday meeting that would cap property valuation increases.

"The end result of an appraised valuation or assessed value cap is that tax bills are no longer distributed fairly and equally, as a resulting tax shift will cause some property owners to pay more than their fair share, while others pay less," Rupp said.

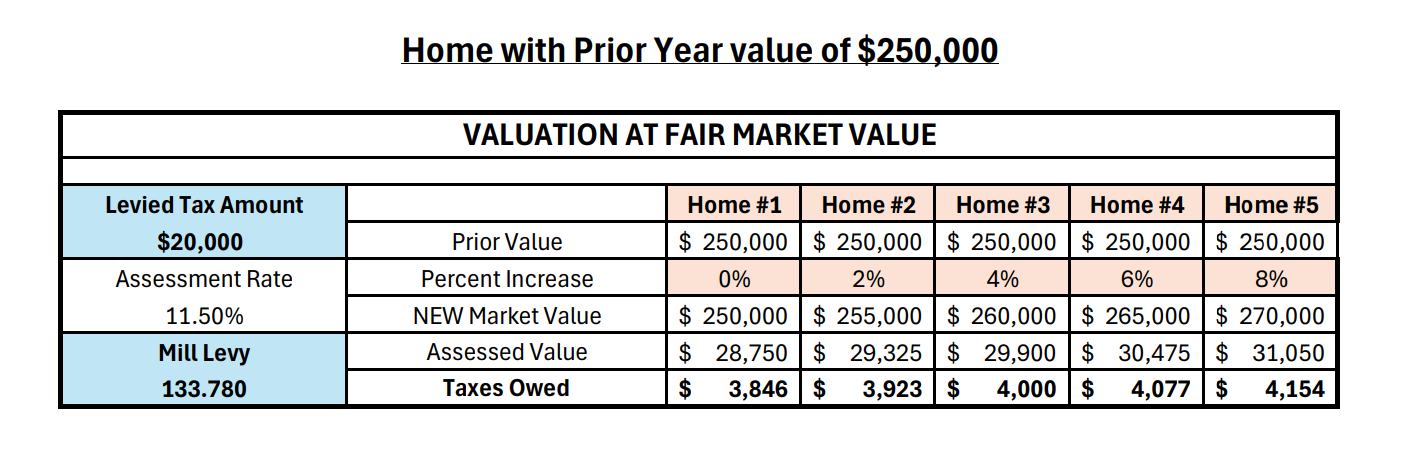

Rupp presented a chart showing five homes valued at $250,000, each increasing in value at different rates from 0% to 8%, which he labeled as fair market value.

New market values ranged from $250,000 to $270,000. Using an established mill levy of 133.780 to raise $20,000 in taxes, the taxes owed from each home ranged from $3,846 to $4,154.

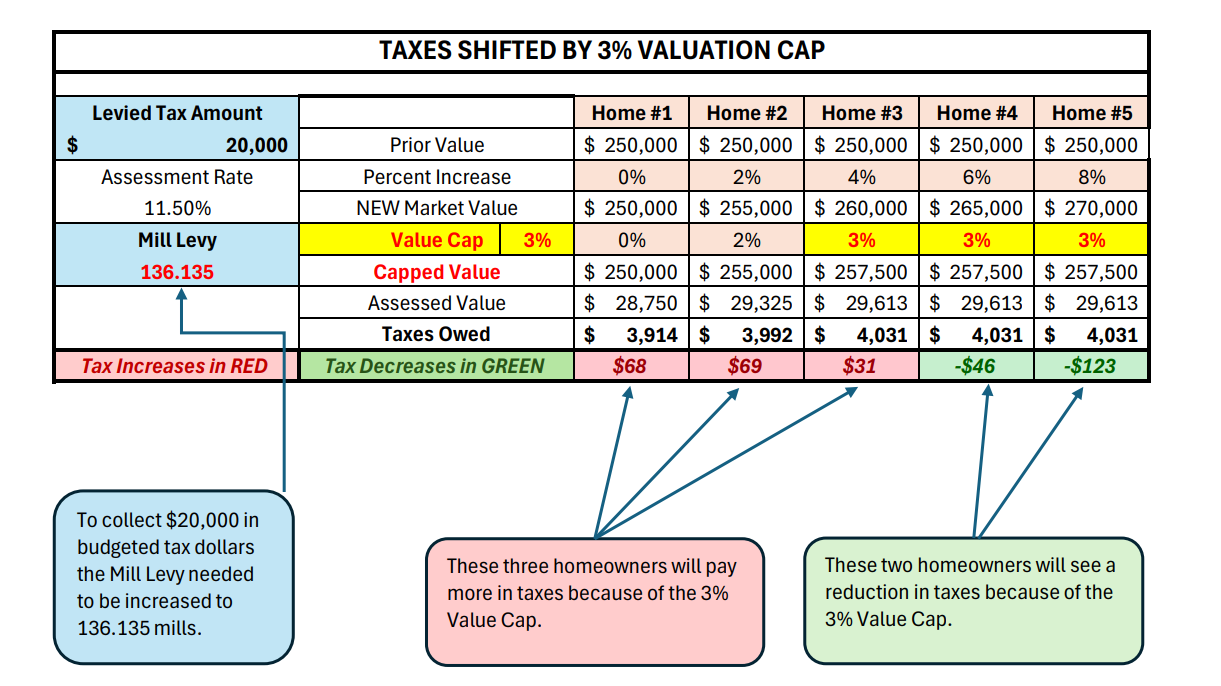

In a second chart, Rupp showed that a 3% value cap limits how much each property’s value can increase, even when new market values increase beyond that limit.

Homes four and five, which increased 6% and 8% in market value, were capped at 3%. To maintain the same $20,000 in total revenue, the mill levy had to be raised to 136.135 mills.

As a result, homes one through three now pay more in taxes due to the higher mill levy, while the higher-valued homes pay less because of the cap.

"Homeowner one is now paying an extra $68 in taxes they would not have paid if a valuation cap were not in place. The same goes for homeowner two, who's paying $69 more in taxes. Property three is a little less because they're closer to that 3% bar," Rupp said.

"Then what happens is homes four and five are actually worth a little bit more. Home four is getting a tax break and paying $46 less than they normally would, and the same for home number five, they're paying $123 less," he said.

Rupp discussed expanding programs like the Safe Senior or Homestead tax relief options, or increasing the state school levy exemption, as fairer methods for tax relief that the Legislature should pursue.

Commissioner Michael Berges said taxation is a "three-legged stool," and when you make changes to one, it destabilizes everything else.

"When people see things like this 3% cap, they initially think it seems like a good idea to save taxpayers," Berges said.

Darin Myers, county administrator, added the scenarios Rupp provided create the false perception that homeowners' taxes are staying lower while others pay more.

Berges said discussions will continue on the role of sales taxes, possibly offsetting property taxes.