By CRISTINA JANNEY

Hays Post

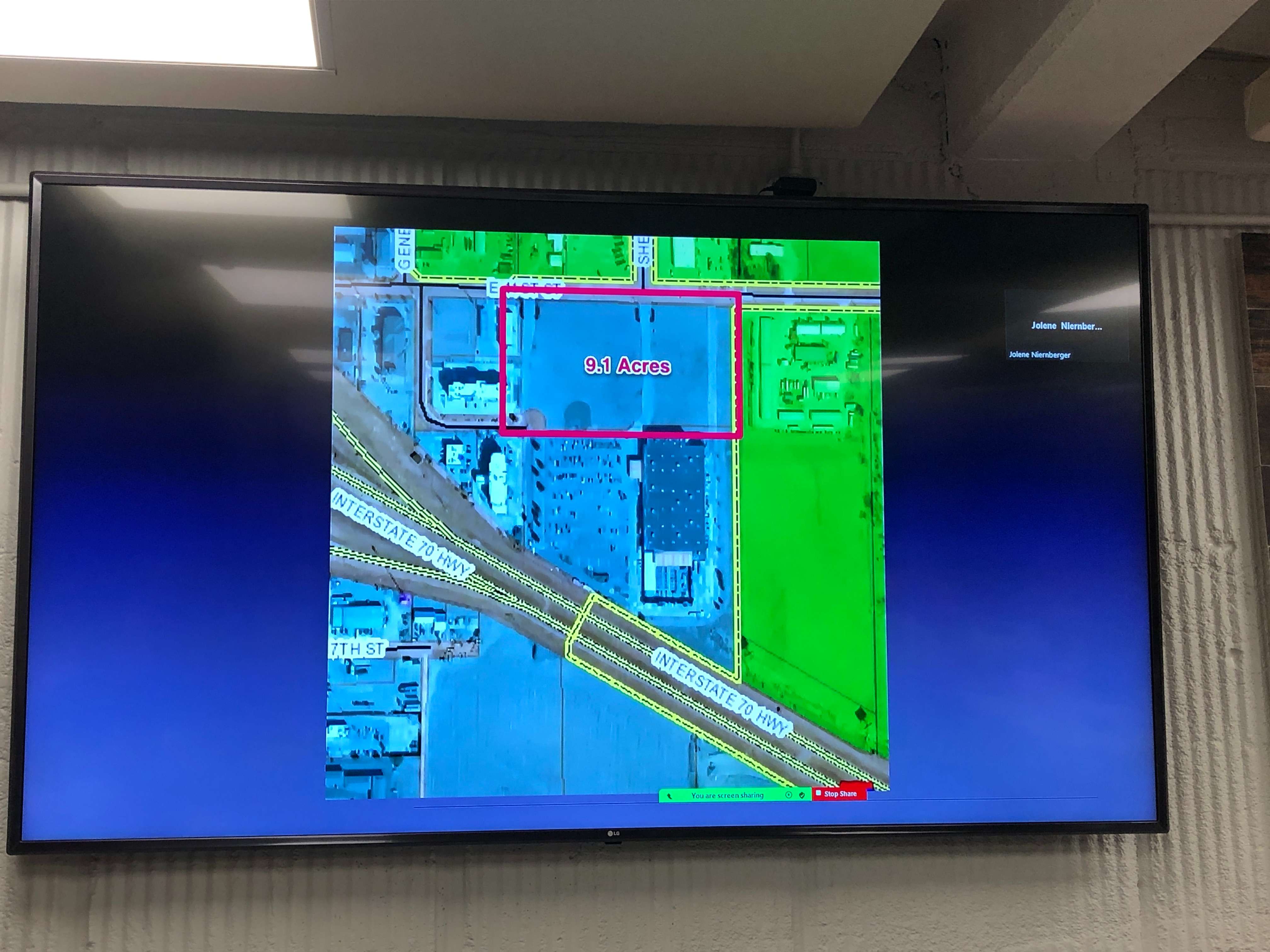

Grow Hays has contracted to purchase 9.1 acres of land north of Home Depot in Hays. They hope to construct a new shopping center on the land.

The land is north of Interstate 70 on East 41st Street.

Williams said Grow Hays looked at three properties north of Interstate 70 near Vine, but the owner of this property was the only one who was interested in selling.

"We have too many real estate speculators in our community and not enough real estate developers who are really sincere about doing something," Doug Williams, executive director of Grow Hays, said. "They just want to ride out the highest prices. It's their land. It's their life, but it's not necessarily positive for the community."

Williams told an audience gathered for Grow Hays' quarterly luncheon on Tuesday another developer had been in talks to bring a new shopping center to Hays.

The developer had multiple big-box retailers interested in Hays.

However, the finances did not work out for a private developer to build a new space in Hays at this time.

The average rent for new space in a community such as Hays is $16 per square foot. Construction costs would be $190 per square foot and the land would cost $15 per square foot.

The investment in a 70,000-square-foot retail space would be $15.3 million.

Based on the rent a developer could hope to collect, the developer would lose about $471,000 per year or more than $7 million over a 15-year leasing period.

Kanas has appropriated $4.447 million to Hays for retail development. This money can be used for land acquisition, building construction, covering rent shortfalls, or infrastructure improvements to foster retail development.

Grow Hays hopes to use all or part of the state funds for the new shopping center. A portion of the $15 million would have to be borrowed from a lender.

Another portion could be funded through a Community Improvement District. This would impose an additional sales tax on shopping center purchases, but the funds could be used to reimburse infrastructure costs.

"To do development today like this or even residential development, you've got to have multiple streams of revenue you can use to try to cover the cost because it's so expensive," Williams said.

Williams estimated the new shopping center would generate $20 million in annual sales, which would generate $600,000 combined annually in additional sales tax for the city of Hays, Ellis County and the Hays USD 489 bond issue.

The city of Hays has a 9.25 percent sales tax. However, a portion of that sales tax goes toward property tax reduction. This results in the lowest city mill levy and the lowest total mill levy compared to peer cities in the state.

See chart below.

Wiliams said he hopes Grow Hays can finalize the sale of the property by the end of July. The project would take about 18 months to complete.

He said the shopping center could accommodate five to six new retailers and the sizes of the spaces would likely vary.

He said he envisioned the building and parking mirroring the footprint on the Home Depot lot. However, Home Depot has line-of-sight restrictions and the shopping center designers must address that issue.

Although Grow Hays will likely be the shopping center's owner initially, Williams said he thought the property would eventually be sold to a private owner.

Williams said Grow Hays continues to work with Big Creek Crossing to try to keep its space full. The mall's owners are struggling with retailers who want outside entrances.

"We do think a rising tide raises all ships, so the more retail we have, the more people will come," he said. "I think there will be residual benefit throughout the retail sector."

Williams said retailers across the region continue to face other common challenges, including competition with e-commerce, construction costs, interest rates and declining population.

Williams said Big Creek Crossing still has opportunities to lure new businesses who want to pay less per square foot than the going rate for new construction.

Williams said residents often point to growth in Garden City and question why Hays has not seen similar growth.

Within a 60-mile radius of Hays, there are about 87,000 people. Within a 60-mile radius of Garden City, there are 123,000 people.

The Garden City area has also seen a slower population decline, 2.9%, in its market area. Although Hays' population did not decrease according to the last census. The surrounding population shrank by almost 6% in a 10-year period.

Williams said Grow Hays has also been working with developers on the area to the north of 24/7 on Vine. He said he sees the Rodeway Inn as another location in need of urban renewal.

"I think these retailers are ready to make moves, and we need to strike while the iron is hot," he said.