By BECKY KISER

Hays Post

Many businesses in Hays are closed following Monday's implementation of the governor's statewide stay-at-home executive order in effect until April 19.

Kansas residents can leave their homes for employment, or to obtain food, medicine and household necessities.

That means fewer people are shopping at local stores — stores that may have already temporarily closed or drastically altered how they're serving customers.

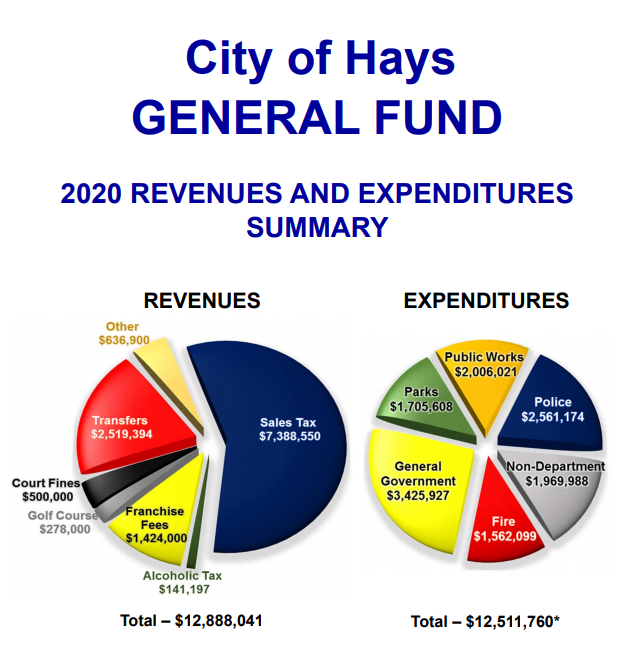

Business has slowed and the net effect is an anticipated drop in retail sales tax revenues for the city of Hays, the primary generator of monies for the city's general fund.

"It's something we're going to feel," City Manager Toby Dougherty said. "And it's probably going to last a long time."

Expenditures from the general fund are used for police, fire, parks, public works and general local government operation.

Dougherty has seen projections statewide of as much as a 25 percent decrease in sales taxes, although no length of time was estimated.

"Whether we feel that much of an impact locally — or even more. I don't know," Dougherty said. "But I do think there's going to be some long-lasting ramifications from this."

Dougherty expects local unemployment numbers to spike, along with those for the entire state which have already reached a record number.

He's also concerned about two major local industries — agriculture and oil.

"Locally, we're dealing with farm commodity prices that weren't good to start with, oil prices are going down, and now this.

"These type of economic hits, as they reverberate through the economy, could last a long time. They could affect property values and things like that."

The economic uncertainty is part of the city's current planning process and the 2021 budget.

"We're looking at what we could come back on and look at less revenues as we prepare for our 2021 budget," Dougherty said.

February's financial report presented by Finance Director Kim Rupp at last Thursday's city commission meeting showed a 2.24 percent uptick in general fund sales tax collections over the previous year.

Rupp noted the figures are from December sales.

The report of Top Ten quarter-to-date sales tax collections by classification was up $175,860 or 9.54 percent.

The largest categorical increase was in supermarkets, convenience and liquor stores, up 30 percent.