By CRISTINA JANNEY

Hays Post

The Hays USD 489 school district is proposing a budget with a mill levy increase.

The district is proposing a .447 mill increase in the tax levy for the supplemental general fund for the 2026 fiscal year.

"Yes, the total taxes levied will go up, so we will exceed the revenue-neutral rate," Chris Hipp, assistant superintendent of business services, said. "The total mill levy crept up a little bit, but mostly because of reductions in state aid and additional costs in special ed."

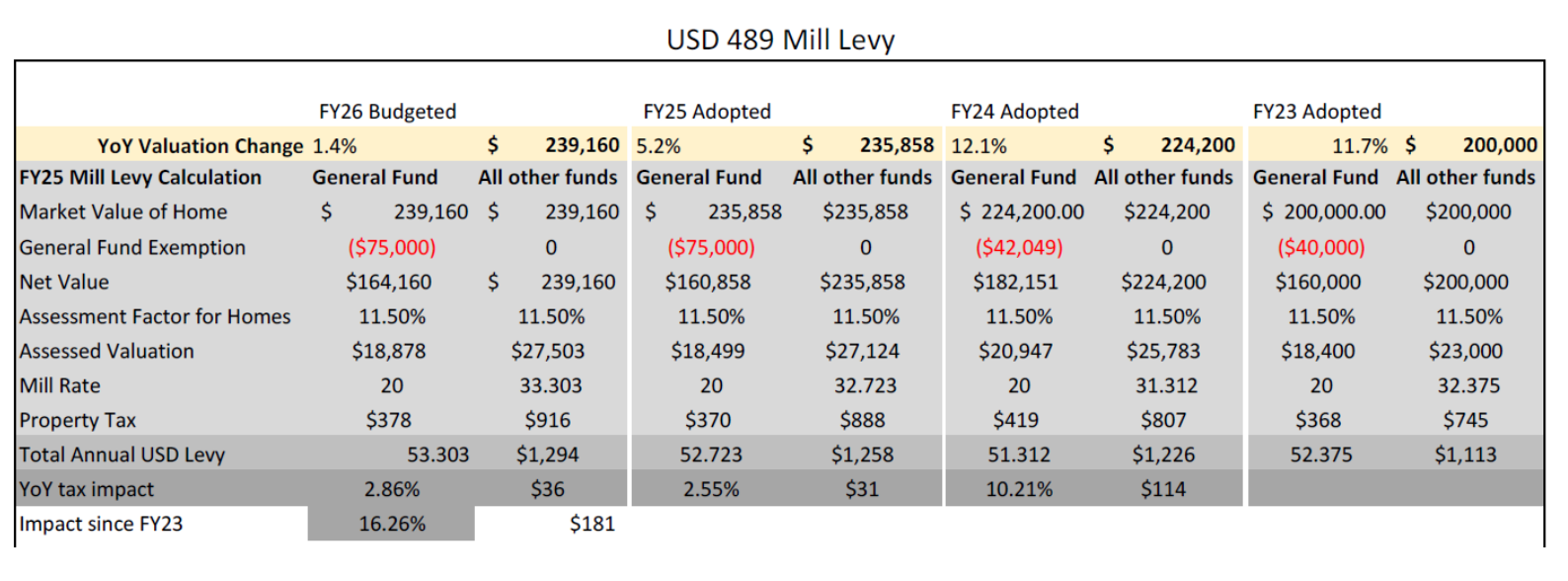

The USD 489's portion of the county valuation increased by about 1.4%.

Taxes on a home valued at $239,000 will go up by about $36 per year, based on the district's mill levy and the increased assessed valuation, according to the school district.

The district is losing about $193,000 in state aid for the supplemental general fund, Hipp said, which means the net increase from that fund is only about $80,000.

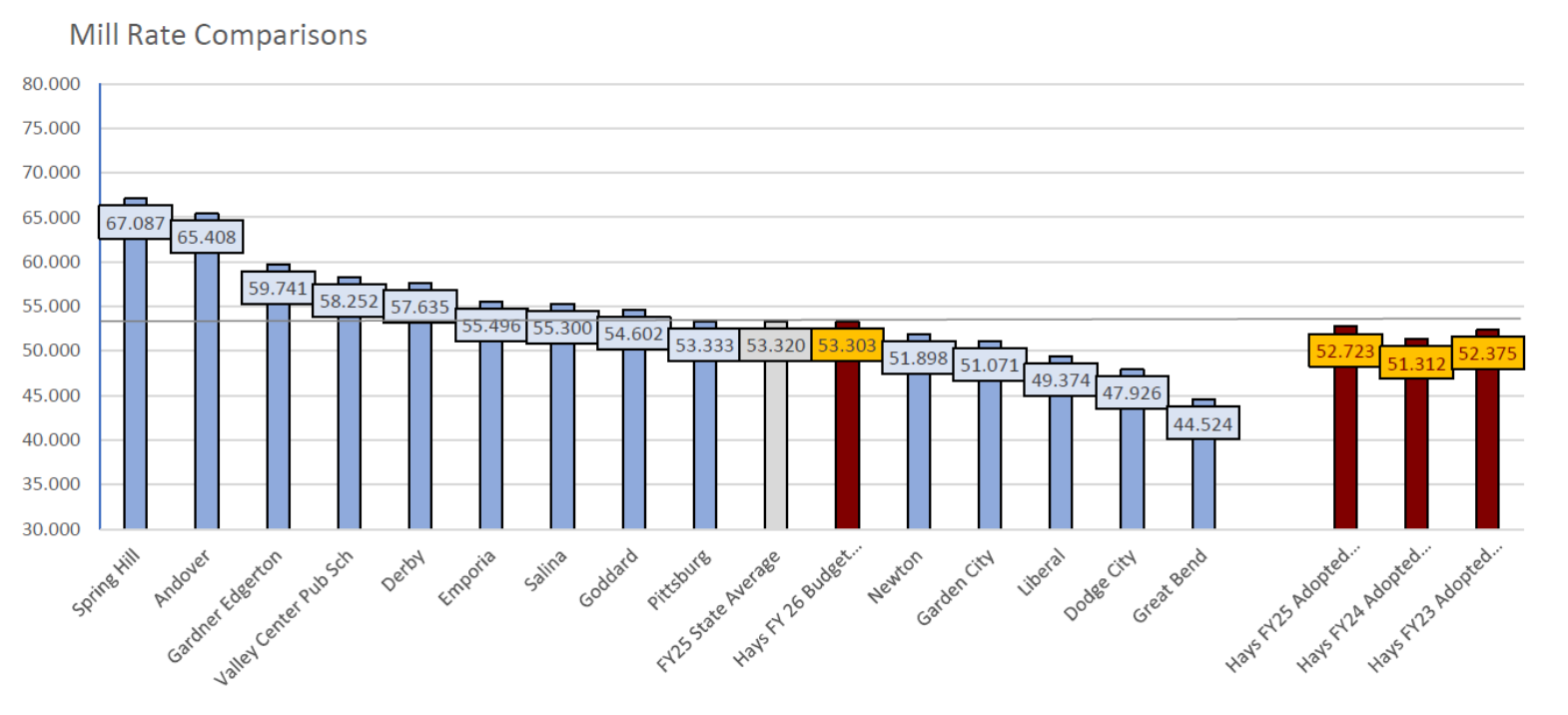

Hays' overall school mill levy is slightly below the state average. That includes the bond mill levy, he said.

The 20 mills that are assessed for schools go to the state and are reallocated to local school districts based on enrollment. The state sets that mill rate, and the local school board has no control over that levy, Hipp said.

The district is predicting a smaller kindergarten class compared to last year's high school graduating class, so it is forecasting a slight decrease in enrollment, Hipp said.

"The student count is what drives everything," Hipp said. "It sets the general fund. So that 20 mills that goes to Topeka, we get back whatever portion of that in the form of state aid."

The district's capital outlay levy is being kept at 8 mills. Although the increase in valuation will bring in another $50,000, the district is losing about $106,000 in state aid, which means the net revenue for capital outlay will be negative, Hipp said.

Thanks in part to the increase in valuation, the budget calls for a slight reduction in the bond and interest mill levy from 11.262 to 11.152 mills. Hipp said the mill rate is calculated based on what the school district needs to make its next bond payment.

The district is in the midst of multiple building construction projects. The largest of those projects is a new Hays High School, which is set to open next week.

The most significant line-item increase in the supplemental general fund budget, about $1 million, is for salary increases.

SEE RELATED STORY: Hays USD 489 board approves 2.5% raise for all personnel

Hipp said the district is saving about $332,000 through position reductions. No one was laid off, but the district left open some positions due to retirements and resignations.

Hipp said this was made possible by smaller class sizes in the lower grades and a move to three elementary school buildings instead of four.

Lincoln Elementary School was permanently closed in the spring.

Special education funding

The district also saw an increase of almost $822,000 for special education. Although Hays hosts the special education cooperation, that figure only includes Hays' portion of the cooperative budget.

Hipp said the school district is facing increasing costs for special education with a decrease in contributions from the state and federal governments.

"Their expenses are set at the student level," Hipp said. "Their expenses are set when we are having individual education plan meetings and deciding on the services kids need. It's federally mandated. It's going to happen."

What is not funded by the state and federal governments has to come from local school districts. Neither the state nor the federal government is fully funding their portions of special education, which is leaving local school districts to pick up more of the tab.

"It's extremely painful across the state," Hipp said.

Hipp said the district has been trying to keep the local mill levy down by using reserve funds, but the district can't use any more reserve without risking not being able to pay its bills.

Kyle Carlin, special education co-op director, said the district has experienced increased costs for salaries, programs for disabled students, programs used by the co-op's speech pathologists and psychologists, and testing.

The state increased funding by $7 million for special education for the 2026 budget year, but that is for the entire state and is less than 1% of the state's special education budget, Carlin said.

Federal funding has been flat. The federal funding gap for the Hays district alone is almost $2.2 million and the state's gap is more than $1 million.

Carlin has been part of the discussions about fulfilling the state funding shortfall, and he was part of a delegation that met with the Kansas Congressional delegation in Washington, D.C., earlier this summer about closing the federal funding gap.

Carlin said he met personally with Rep. Tracey Mann, R-Kan., who said he was interested in new legislation that would fully fund the federal obligation for special education using a stair-step approach over 10 years.

Carlin said Mann expressed concern about the special education law as an unfunded mandate.

"Each student brings with them their own individual needs that we have an obligation to meet," Carlin said. "Even though the feds are funding at 12% of their obligation and the state is funding at less than 70% of their obligation, we are still responsible for 100% of that law.

"Luckily, I work with districts that are committed to maintaining that and doing the best for kids."

The district's revenue-neutral rate and budget hearings are scheduled for the Sept. 8 board meeting.